FIFO (First In, First Out) and LIFO (Last In, First Out) are inventory valuation methods that impact cost of goods sold and tax liabilities differently, with FIFO assuming older inventory is sold first and LIFO assuming the newest inventory is sold first. Understanding these distinctions can help you optimize your accounting strategy and financial reporting--explore the full article to learn how each method affects your business performance.

Table of Comparison

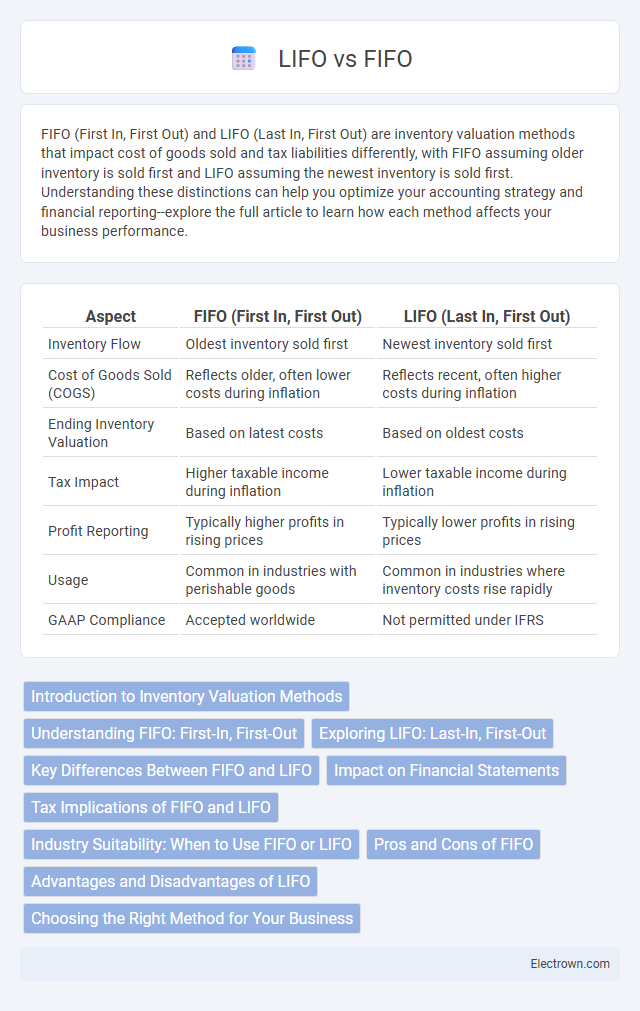

| Aspect | FIFO (First In, First Out) | LIFO (Last In, First Out) |

|---|---|---|

| Inventory Flow | Oldest inventory sold first | Newest inventory sold first |

| Cost of Goods Sold (COGS) | Reflects older, often lower costs during inflation | Reflects recent, often higher costs during inflation |

| Ending Inventory Valuation | Based on latest costs | Based on oldest costs |

| Tax Impact | Higher taxable income during inflation | Lower taxable income during inflation |

| Profit Reporting | Typically higher profits in rising prices | Typically lower profits in rising prices |

| Usage | Common in industries with perishable goods | Common in industries where inventory costs rise rapidly |

| GAAP Compliance | Accepted worldwide | Not permitted under IFRS |

Introduction to Inventory Valuation Methods

FIFO (First In, First Out) and LIFO (Last In, First Out) are primary inventory valuation methods used to determine the cost of goods sold and ending inventory value. FIFO assumes that the oldest inventory items are sold first, leading to higher net income during inflationary periods, while LIFO assumes the newest items are sold first, often resulting in lower taxable income. Understanding how FIFO and LIFO impact your financial statements and tax obligations can help you choose the most beneficial inventory accounting approach.

Understanding FIFO: First-In, First-Out

FIFO (First-In, First-Out) inventory accounting method assumes that the oldest inventory items are sold or used first, providing a clear reflection of current market costs on your financial statements. This approach helps in accurately matching revenues with expenses and is widely used in industries with perishable goods to minimize obsolescence. Understanding FIFO enhances your ability to manage stock efficiently and maintain transparent cost flow during periods of fluctuating prices.

Exploring LIFO: Last-In, First-Out

LIFO (Last-In, First-Out) inventory accounting assumes the most recently acquired items are sold first, which often results in higher cost of goods sold and lower taxable income during inflationary periods. This method is widely used in industries where inventory items are perishable or have short life cycles, such as in the chemical or technology sectors. LIFO's emphasis on matching current costs with current revenues provides a more accurate reflection of profitability in volatile market conditions.

Key Differences Between FIFO and LIFO

FIFO (First-In, First-Out) assumes that the oldest inventory items are sold first, resulting in lower cost of goods sold and higher ending inventory values during inflation. LIFO (Last-In, First-Out) assumes the newest inventory is sold first, leading to higher cost of goods sold and lower taxable income in inflationary periods. The key differences impact financial statements and tax liabilities, with FIFO providing more accurate inventory valuation and LIFO offering potential tax advantages.

Impact on Financial Statements

FIFO (First-In, First-Out) results in lower cost of goods sold and higher ending inventory during periods of rising prices, increasing net income and taxable income on financial statements. LIFO (Last-In, First-Out) produces higher cost of goods sold and lower ending inventory, reducing net income and income taxes but potentially understating asset values on the balance sheet. The choice between FIFO and LIFO significantly affects profitability metrics, tax liabilities, and inventory valuation, influencing financial analysis and decision-making.

Tax Implications of FIFO and LIFO

FIFO (First-In, First-Out) typically results in higher taxable income during periods of rising prices because older, lower-cost inventory is expensed first, leading to higher reported profits. LIFO (Last-In, First-Out) reduces taxable income by matching recent, higher-cost inventory against current revenues, resulting in lower profits and thus lower tax liabilities. Companies operating under LIFO can defer tax payments, improving cash flow, but must comply with specific IRS regulations to maintain this accounting method.

Industry Suitability: When to Use FIFO or LIFO

FIFO is ideal for industries dealing with perishable goods, such as food and pharmaceuticals, where inventory freshness and expiration dates are critical. LIFO suits industries with non-perishable or durable goods, like manufacturing and retail, especially when managing rising costs and inflation for tax advantages. Companies should select FIFO for accurate inventory valuation during stable markets and LIFO to reduce taxable income during periods of increasing prices.

Pros and Cons of FIFO

FIFO (First In, First Out) ensures that the oldest inventory is sold first, which helps maintain accurate financial statements during periods of rising prices by reflecting lower cost of goods sold and higher net income. This method reduces the risk of inventory obsolescence and spoilage, making it ideal for perishable goods or products with expiration dates. However, FIFO may result in higher tax liabilities due to increased profits and can distort profit margins in inflationary environments.

Advantages and Disadvantages of LIFO

LIFO (Last In, First Out) offers tax advantages by matching recent higher costs against current revenues, which can reduce taxable income during inflationary periods. However, it may undervalue inventory on the balance sheet and distort profit margins due to older costs remaining in inventory. Your financial statements might not reflect current market conditions accurately when using LIFO.

Choosing the Right Method for Your Business

Choosing the right inventory valuation method between FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) depends on your business's financial goals and industry characteristics. FIFO is ideal for businesses with perishable goods, as it aligns with actual inventory flow and often results in higher net income during inflationary periods. LIFO can provide tax advantages by matching recent higher costs against current revenues, benefiting companies in industries facing rising material prices but may not comply with international accounting standards.

FIFO vs LIFO Infographic

electrown.com

electrown.com